Featured

Table of Contents

When credit rating card balances spiral beyond control and monthly minimal settlements hardly scratch the surface of what you owe, the weight of economic stress can feel unbearable. With American customers currently holding over $1.21 trillion in bank card debt jointly, locating legit financial debt relief has actually never ever been extra important. Nearly fifty percent of cardholders bring a balance from month to month, and the portion falling back on minimum repayments has climbed to 12.3% in current information.

For those seeking a path out of overwhelming financial obligation, recognizing the difference in between financial debt forgiveness, bankruptcy counseling, and financial obligation monitoring can imply the difference between economic recovery and deeper problem.

What Financial Debt Mercy Really Suggests

Financial debt forgiveness refers to the procedure of bargaining with lenders to decrease the overall quantity owed, permitting customers to resolve their debts for much less than the original balance. Unlike financial debt loan consolidation, which incorporates several financial debts right into a solitary repayment, or financial debt monitoring plans that restructure repayment timetables, financial debt mercy programs proactively function to eliminate parts of your outstanding balances.

When a bank card account goes overdue for 120 days or even more, financial institutions often bill off the financial debt and may approve lowered negotiations to recuperate a minimum of a section of what they're owed. Settlements normally range from 30% to 50% of the original equilibrium, though outcomes vary based upon the financial institution, account age, and private conditions. The majority of debt mercy programs cover 2 to 4 years, needing clients to develop funds in dedicated accounts while arbitrators work with creditors.

It deserves noting that forgiven debt over $600 is generally thought about taxed revenue by the IRS. Anyone thinking about financial obligation negotiation must consult a tax obligation specialist to understand the effects prior to proceeding.

The Critical Distinction In Between Nonprofit and For-Profit Services

The Consumer Financial Defense Bureau cautions that handling for-profit financial obligation negotiation business can be high-risk. These firms generally bill fees ranging from 15% to 25% of enlisted financial debt and commonly motivate customers to stop paying completely while settlements proceed. This method can result in mounting late charges, penalty interest fees, damaged credit report, and also suits from lenders.

Not-for-profit credit scores counseling firms run under various standards. Organizations accepted by the united state Division of Justice as 501(c)(3) nonprofits focus on client welfare instead of revenue margins. Their credit rating therapy sessions are typically used free of fee, and debt management program fees are topped at $79 regular monthly across the country under government policies.

The National Foundation for Debt Therapy (NFCC), established in 1951, stands for the gold criterion for nonprofit economic therapy. NFCC participant agencies have to fulfill stringent moral standards, with therapists needed to recertify every two years. Research study conducted by Ohio State College located that NFCC credit scores counseling customers decreased their revolving debt by $3,600 more than contrast teams over 18 months adhering to therapy, with 70% reporting boosted monetary self-confidence.

Personal Bankruptcy Counseling: Comprehending Your Lawful Requirements

For people whose economic situations have actually weakened beyond what financial debt mercy or monitoring programs can address, insolvency may become necessary. Federal law needs anybody declare Chapter 7 or Phase 13 personal bankruptcy to finish both pre-filing credit rating counseling and post-filing borrower education courses through an accepted agency.

Pre-bankruptcy therapy includes an extensive review of revenue, financial obligations, and expenditures, in addition to exploration of alternatives to bankruptcy. The session helps filers recognize whether insolvency genuinely represents their best alternative or whether various other financial debt relief methods may work. Post-filing borrower education and learning concentrates on budgeting, conserving, and restoring credit score after insolvency discharge.

Both sessions commonly take 60 to 90 minutes. Charges differ by supplier yet generally variety from $20 to $50 per training course, with fee waivers readily available for those who qualify based upon revenue. Upon conclusion, filers obtain certificates required for their bankruptcy petitions.

Not-for-profit agencies like APFSC offer these required insolvency therapy programs alongside their various other debt relief services, providing a streamlined experience for those navigating the insolvency procedure.

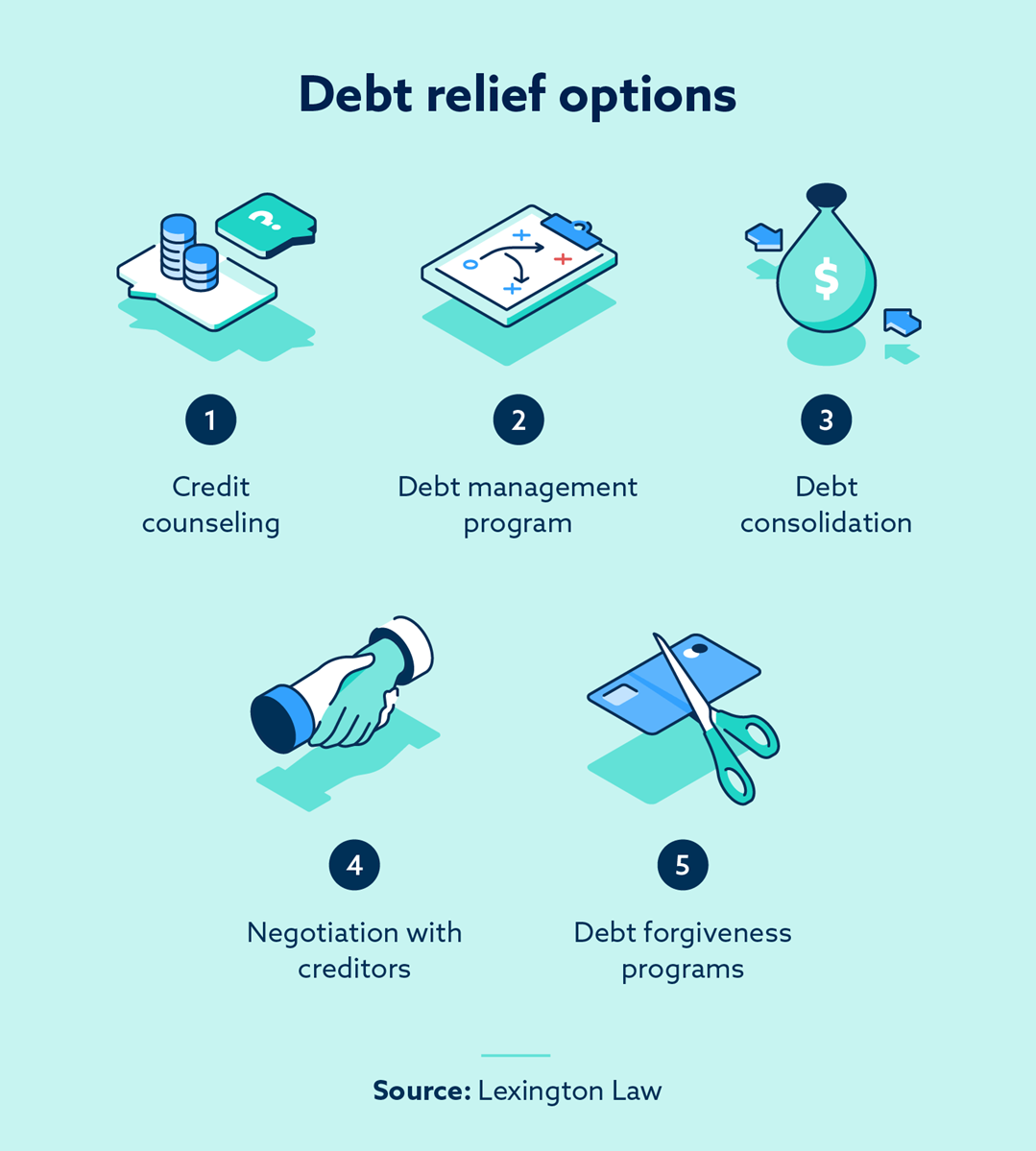

Comparing Your Debt Alleviation Options

Understanding which come close to fits your scenario calls for honest analysis of your economic situations.

Debt monitoring prepares job best for those who can still make constant repayments however require helping in reducing rate of interest prices and organizing several financial debts into single monthly payments. These programs typically span 3 to five years and pay debts completely, just with far better terms. Credit report usually improve with time as equilibriums decrease.

Financial debt negotiation or mercy programs suit those with bigger debt tons, typically $7,500 or more, who have actually already fallen back on payments and can not reasonably pay balances completely. These programs discuss decreased paybacks yet carry credit history score repercussions and tax implications.

Personal bankruptcy provides one of the most dramatic relief yet additionally one of the most considerable lasting credit rating effect. Chapter 7 sells off assets to release debts, while Phase 13 develops organized repayment plans over 3 to 5 years. Bankruptcy continues to be on credit records for seven to 10 years.

Credit report counseling alone, without registration in a particular program, helps those who require budgeting guidance and financial education and learning to avoid future financial debt troubles. These sessions are commonly free via not-for-profit firms.

Indication of Financial Debt Relief Scams

Consumers ought to be especially skeptical of business asserting to offer government-sponsored bank card debt mercy programs. No such federal programs exist for charge card financial obligation, unlike the mercy options readily available for government student loans. Any kind of advertisements recommending or else are most likely rip-offs.

Various other warnings include firms that require huge in advance costs prior to providing services, assurance specific settlement percents, inform you to stop communicating with lenders entirely, or refuse to explain their fee framework plainly. Genuine nonprofit agencies offer transparent details concerning expenses, timelines, and realistic outcomes.

The CFPB recommends considering all options before engaging any financial obligation relief solution, including working out directly with creditors yourself and seeking advice from with not-for-profit credit rating counselors that can give honest assessments of your scenario.

Making an Informed Decision

Choosing the right financial debt relief path depends on private conditions, total financial debt amount, revenue stability, and ability to make constant payments. Free first examinations from nonprofit credit score therapy agencies aid possible customers understand their alternatives without high-pressure sales tactics.

During these sessions, licensed counselors examine financial scenarios, describe available programs, and create tailored recommendations. Whether a person ultimately selects financial debt forgiveness, debt management, personal bankruptcy, or self-directed repayment, starting with nonprofit guidance guarantees they get advice focused on their monetary health and wellbeing.

Market leaders like Money Management International, GreenPath Financial Health, InCharge Debt Solutions, and APFSC all supply extensive services spanning credit scores counseling, financial obligation management, and bankruptcy education and learning. The majority of provide multiple call methods consisting of phone, on-line conversation, and e-mail, making it simple to begin the discussion.

Taking the Initial Step

Financial healing seldom takes place overnight. Financial obligation administration plans commonly span 3 to 5 years, and financial debt settlement programs usually call for 24 to 48 months of organized savings and negotiations. However, the option of proceeding to have problem with unmanageable debt while interest substances supplies no course forward.

For anyone sinking in credit history card debt, medical expenses, or individual financings, getting to out to a nonprofit credit history counseling company represents a vital very first step. The assessment costs absolutely nothing, carries no commitment, and supplies clearness regarding realistic choices. From there, educated choices come to be feasible.

Life After Credit Counseling: Action Plan and Check-InsThe journey from frustrating financial obligation to financial security requires commitment, perseverance, and expert guidance. With assistance from trusted not-for-profit agencies and a clear understanding of readily available programs, that journey comes to be attainable.

Table of Contents

Latest Posts

Some Known Details About Is Debt Forgiveness Appropriate for Your Situation

The smart Trick of Initial Meeting and What to Expect That Nobody is Talking About

Some Known Questions About Resources Provided Via APFSC.

More

Latest Posts

Some Known Details About Is Debt Forgiveness Appropriate for Your Situation

The smart Trick of Initial Meeting and What to Expect That Nobody is Talking About

Some Known Questions About Resources Provided Via APFSC.